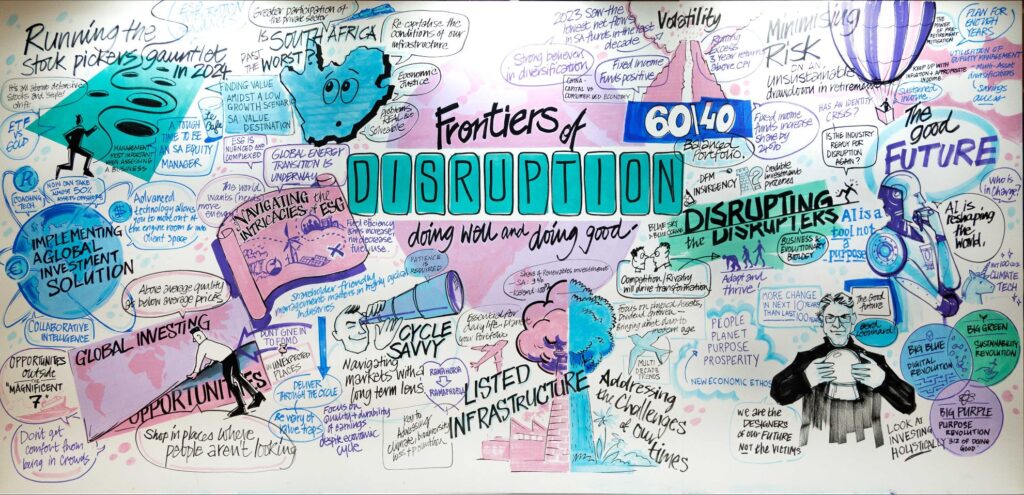

At The 2024 Investment Forum, we had an artist construct a 6 meter wall and build out key takeaways from the event yesterday. He sketched this as the day progressed and delegates loved it!

Our new webinar platform – a derivative of our FundHub platform is now live. Joining us this morning is Philip Bradford from PortfolioMetrix where he is discussing “Is SA fixed income poised to provide equity-like returns with lower risk?” #thecollaborativeexchange

Consolidation, attrition and exits continue to happen unabated in the UK’s financial advisory industry. Will South Africa suffer the same fate? Your thoughts? https://www.ftadviser.com/your-industry/2024/02/21/britain-has-lost-435-financial-advice-firms-since-2022/

Over the past decade returns from this sector has been rather muted with the average balanced fund delivering returns of about 2% in excess of CPI. This begs the question of whether the “tools” or the “toolbox” need to change

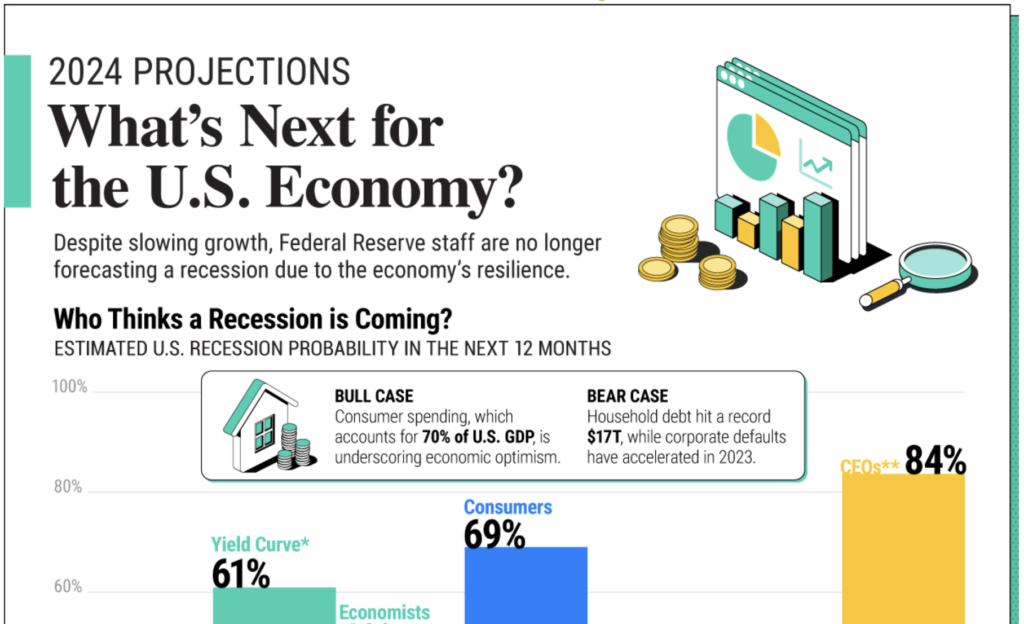

“The market had gotten ahead of itself a bit at the end of the year, but the economic data has been resilient and the Fed has talked down some expectations of rate cuts.” It is going to be very difficult

The Collaborative Exchange is delighted to announce that registration for the 2024 Investment Forum is now open. This conference is the premier gathering of investment managers, DFMs, Multimanagers, financial advisers and wealth managers in South Africa.Now in its 14th year,

Rishi Nalan Kumar is unveiling the astounding power of AI’s exponential learning capability, a game-changer that can reshape your approach to financial planning. 🚀 Explore concrete examples of how AI is already making waves in financial services, from predictive analytics

What a phenomenal session dealing with “Where have all the clients gone” at the Virtual Financial Planning Summit. Moderated by Lauren Marsh (Walker) and including panelists @AndreasKrensel alexa horne and @CobusKruger. Fascinating stats on immigration and emigration. #thecollaborativeexchange Currency Partners

The market commentators have not got this correct in the past, so don’t bank on any of these forecasts now?