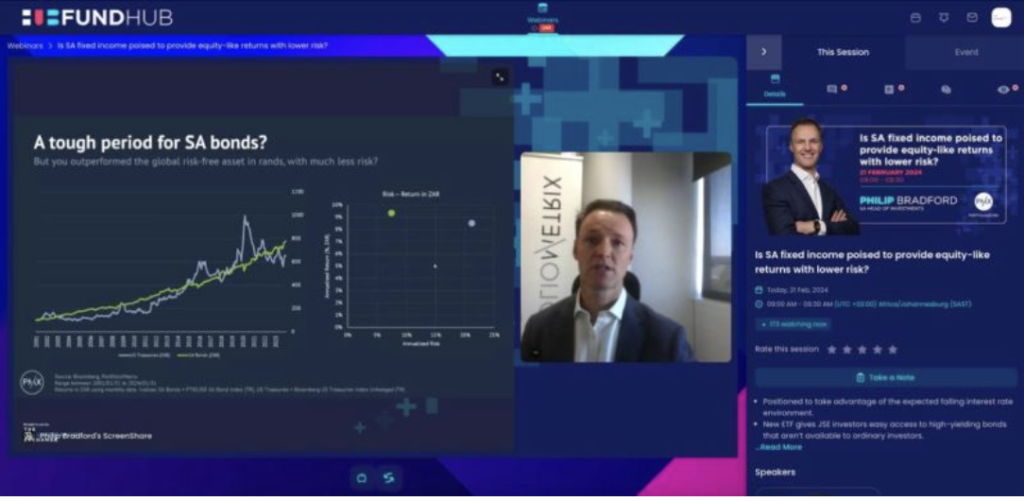

Don’t think about “baby boomers”, Gen X and Gen Y differently and believe that they have not been “re-wired” to the new world. They think about advice differently and expect to interact with advisors in a different way. They like to stay in control of their financial lives and understand the advice they receive and make important decisions themselves. They are increasingly comfortable in doing their own research and believe in the wisdom of their peers. They feel that they are entitled to investment products and strategies that have been the domain of the institutional market, including unlisted securities and look beyond traditional fixed income and equity strategies. They don’t want to be a “second class” investor. They also want a rich digital experience and should be able to access advice anywhere and at any time, through multiple channels and devices as part of a cohesive, rich digital experience.

Whereas these trends are scientifically documented, this is what all my family, colleagues and friends are telling me. Makes you think, doesn’t it?